The property market post Covid

Michael Ley | May 2020

In this current climate you’ll be hard pressed to find a single industry or person unaffected by the events since COVID-19 reached the shores of the developed West. Like a black hole, this invisible threat has swept across nations without prejudice, pulling in every fabric of a capitalist society and left uncertainty, instability and incalculable human loss in its wake. As a result, in just a few short months the world economy has come to an almost grinding halt in what is quite considerably one of the sharpest contractions in the modern era.

From restaurants to retailers and lenders, the reverberating effects of this airborne giant are being felt on a physical level, in both body and in pocket. However, emotions within the residential property sector will largely be dependent on what side of the fence you’re on. As things currently stand interest rates in the Western world are near zero. Whilst we may see some increase to this, once the proverbial industrial furnaces begin to fire up and the wheel starts turning again, this will be a gradual and long-term process. With wages and livelihoods taking such a tremendous hit, any near future steep increases are highly improbable as this would simply spook consumers, investors and trigger defaults at an unprecedented degree.

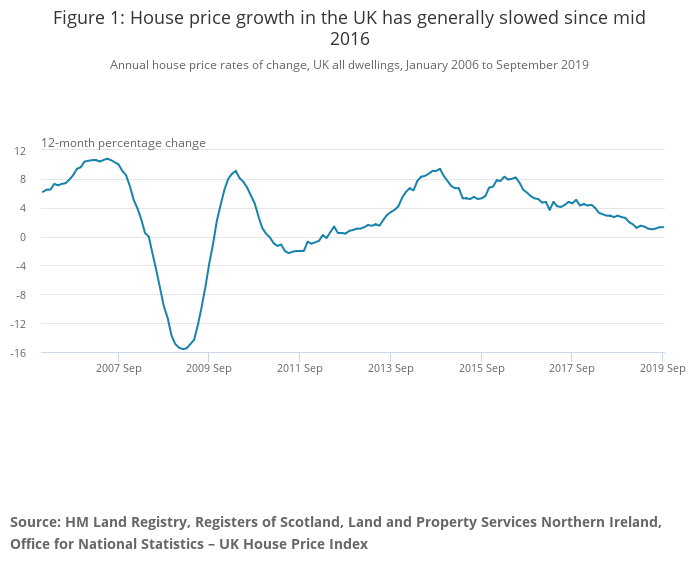

Property growth

As of writing, The Guardian has reported that almost 400,000 home sales worth £82bn have been placed on hold, following government guidelines to delay moves where legally possible whilst distancing protocols are in place. Now the severity of this pinch will derive some causality from unfortunate timing, with the handbrake being applied in the height of the popular housing Spring Sale season. As such Zoopla reports demand to have dropped by 70% Y.O.Y.

As the market sits in forced suspended animation, it’s important to note that whilst physical ‘demand’ is an important metric for understanding the now, contemplation of purchase shouldn’t be discredited as an indicator for futurology. Right now, on mass, people are not making direct moves within the market which affect measurable demand metrics. Instead they are patiently waiting to see what unfolds before making their move, perhaps even as soon as later in the year. This is particularly prevalent for those purchasing second homes to let or develop. With talks and rumours of a temporary removal of stamp duty as a vehicle to kick start the housing market on the table, it’s unsurprising that very few are making premature moves without concrete facts. After all, why force through any purchase now, if you stand to save £000’s simply by delaying?

What are the advantages?

Well, there are of course tremendous advantages to making moves in the market now. Whilst a complete price collapse isn’t inevitable, there will certainly be falls. This is estimated by Knight Franks to be around a 3% fall in price, whilst Savills forecast this to be more around the 5%-10% mark. For those who are looking for real estate opportunities, this is the perfect time to take advantage of the lower purchase price and invest in development or renovation. Even if physical surveying is out of the picture short to midterm, there is nothing stopping prospectors from hiring agents, completing mortgages or utilising development consultancy to add real value to your existing or growing portfolio, ready to sell on within a healthier priced housing market.

Even if ‘buy to sell’ isn’t your game, purchasing in these times has tremendous value potential for those investing in ‘buy to let’. We have, in the UK, a generation of young professionals for whom home ownership is a fallacy possible only to those with rich parents; a view that is one very much affiliated with ‘Millennial socialism’. As such, this zeitgeist has largely been reflected in the growth of a bohemian generation in the UK, which in terms of housing has shifted towards a rental paradigm closer to that of our European neighbours. An issue even prior to COVID- 19 has been a lack of housing suitable for working in thriving cities where jobs are plentiful for a young, ambitious and skilled workforce, that are fit for purpose, and affordable homes to accommodate them is left wanting. As a result, we have had bustling cities without space to grow, held back by heavy regulation preventing the types of construction- studios and flats - which a modern city economy is so desperately crying out for.

However, a recent relaxation of such legislation, allowing the conversion and development of property into rental accommodation ideal for young professionals, has provided both a lucrative and multi beneficial opportunity to seize in this climate. Where there is tremendous potential within a post COVID-19 world is through the conversion of commercial to residential property. The events of social distancing and forced closures may lead to an increase in empty high streets to an extent not seen since 2008. With the sight of boarded up stores not being something that sits well with any stakeholder, re-purposing commercial to the residential property sorely desired in the city seems both the most ethical and viable commodity to come out of a time of great difficulty.

When the world does eventually get back to some sort of normality and the depth of recession/ treasury spend is evaluated it’s highly unlikely that authorising or investing in the construction of new homes will be high on the government’s agenda. It will therefore be down to private enterprise, acquisition and development to provide the post COVID-19 UK with future-worthy residential living. Whether you are looking to expand your portfolio or drive real value in your investments, this current climate is just the time in which to start.